BMIT Technologies today reported record financial results for 2024, marking a year of strong performance and continued progress on its transformation strategy.

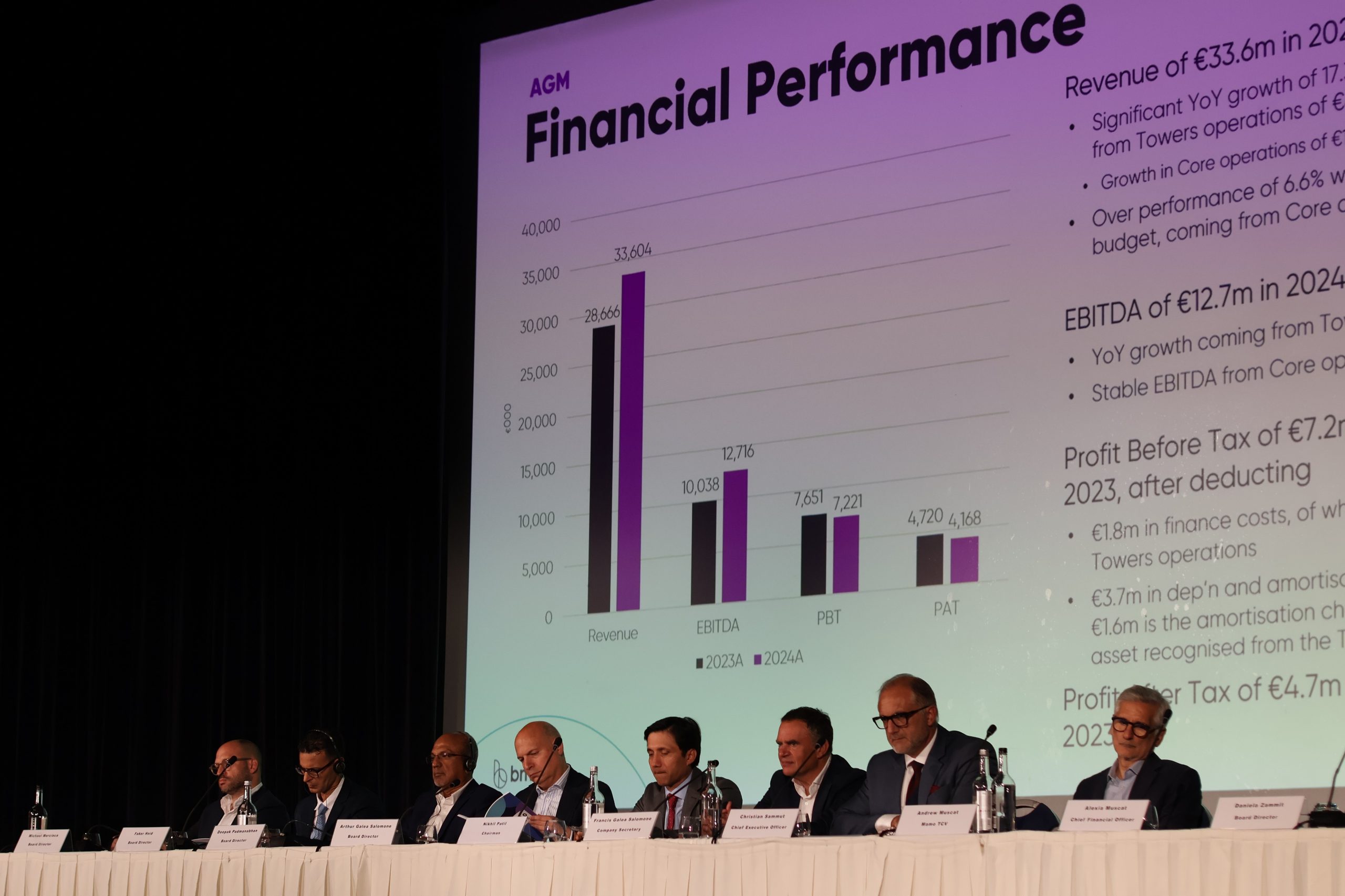

The company posted €33.6 million in revenue, up 17.2% year-on-year, while EBITDA rose 26.7% to €12.7 million. The board has approved a net dividend of €4 million, or €0.0189 per share, with a scrip option.

Alongside the financial performance, BMIT continued to evolve its business model with investments across cloud, digital infrastructure and cyber resilience. The company consolidated its position in Malta’s digital infrastructure space following the acquisition of passive mobile assets that power one of the country’s largest 5G networks, and also strengthened its multicloud capabilities through a majority stake in AWS-focused 56Bit Limited.

Record-breaking year

“2024 was a record-breaking year for BMIT,” Chairman Nikhil Patil told shareholders at the company’s Annual General Meeting today. “Not only did we deliver exceptional results, but we also undertook a fundamental transformation of our business and our business model.”

He added that the company’s long-term growth depends on continued diversification and strategic investment. “Every country now needs both a data centre strategy and a digital infrastructure strategy. BMIT is positioning itself to be central to both.”

CEO Christian Sammut said the results reflect the company’s disciplined execution and sharper focus on customer value. “The success we have achieved is the result of a clear strategic vision, the disciplined execution of this plan, and a continuous effort to put the needs of our clients first.”

Future growth

BMIT also laid the groundwork for further growth. It expanded its managed services portfolio, added new capabilities in governance and compliance, and deepened its reach in hybrid IT. The company is now the only operator in its sector to make use of all subsea cables currently connecting Malta to international routes, strengthening its resilience and connectivity.

Looking ahead, BMIT said its 2025 priorities will remain focused on execution, capability-building, and sustainable growth. It is exploring opportunities in AI clusters, next-generation data centres, and supporting infrastructure to capitalise on the momentum created by AI. The company is actively exploring adjacent growth areas that complement its digital infrastructure strategy, with a focus on telecommunication infrastructures, emerging technologies and future-ready services.

The financial results for the year ended 31 December 2024 were approved at the company’s Annual General Meeting earlier today. The final dividend will be paid on 11 July 2025.